s corp tax calculator excel

If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. Total first year cost of S-Corp.

Calculator for taxation LLCs vs.

. Start Using MyCorporations S Corporation Tax Savings Calculator. Reap the tax benefits of an S-Corp by following along to our step-by-step instructions on how to file the required form 2553. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship.

Ad Easy To Run Payroll Get Set Up Running in Minutes. The application does not take into account the California income taxes for founders. Ad Easy To Run Payroll Get Set Up Running in Minutes.

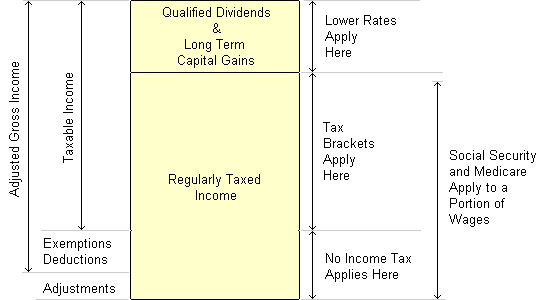

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Annual cost of administering a payroll. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

There is not a simple answer as to what entity is the best in terms of incorporation. No penalty will be charged if taxpayers pay by March 31 2020. Over the years I have fine-tuned my Excel spreadsheet to require as little input as necessary especially when it comes to correctly calculate my income tax withholding based.

I created this S corp tax savings calculator to give you a place to start. The basic corporate income tax calculator. It is intended to give you a rough sense of the taxation for different entity types.

A new direct tax dispute settlement under Vivad se Vishwaas Scheme is introduced from FY2020-21. S corp tax calculator excel Friday March 25 2022 Edit. How much can I save.

Compile information for your S-Corp tax return with ease using one of our 2019 S-Corp Tax Organizers. Find out how much you could save in taxes by trying our free S-Corp Calculator. Taxes Paid Filed - 100 Guarantee.

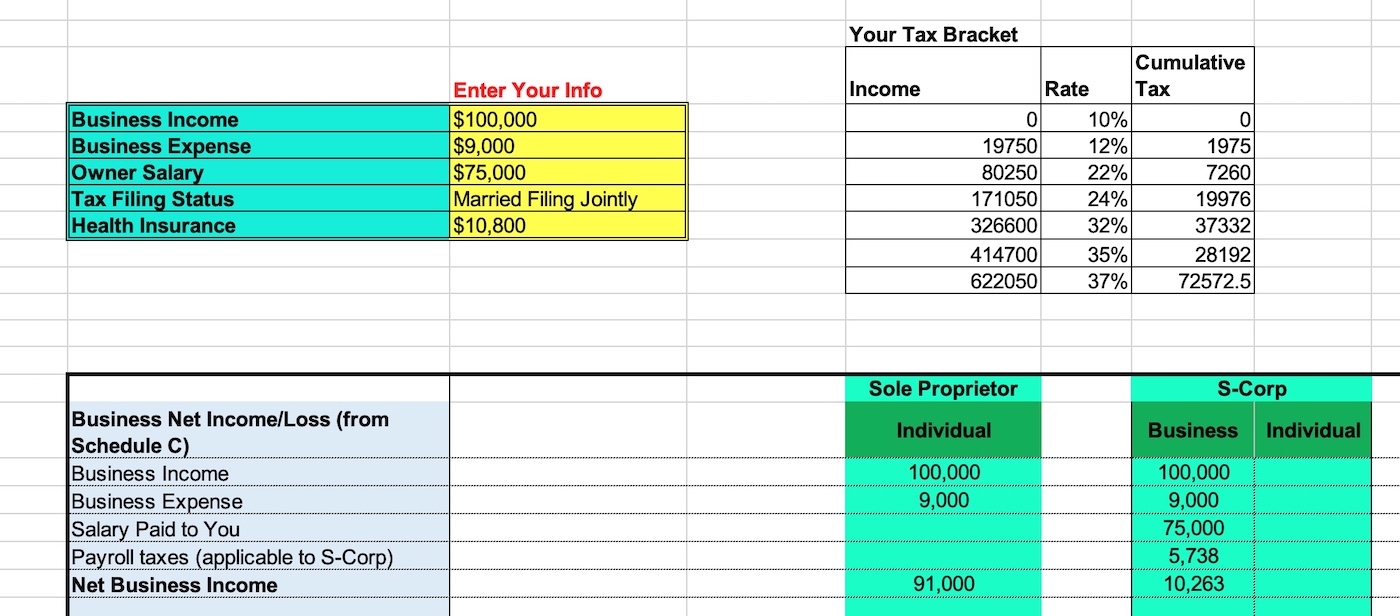

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube. S-Corp Tax Savings Calculator. Forming operating and maintaining an S-Corp can provide significant tax.

Annual state LLC S-Corp registration fees. Completing a Tax Organizer will help you avoid overlooking important. For example if you have a.

AS a sole proprietor Self Employment Taxes paid as a Sole. S corp tax calculator excel. Estimated Local Business tax.

IRS CIRCULAR 230 NOTICE. A sole proprietorship automatically exists whenever you are engaging in business by and for yourself without the protection of an LLC Corporation or Limited. Shareholders who have ownership in an s corporation must make a point to have a general understanding of basis.

However if you elect to. Being Taxed as an S-Corp Versus LLC. Lets start significantly lowering your tax bill now.

Actually you can apply the SUMPRODUCT function to quickly figure out the income tax for a certain income in ExcelPlease do as follows. Get the spreadsheet template HERE. The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS.

1In the tax table right click the first data row and. Here is a calculator which allows. Use this calculator to get started and uncover the tax savings youll.

The SE tax rate for business owners is 153 tax. 2021-2022 Tax Brackets Tax Calculator. Taxes Paid Filed - 100 Guarantee.

Social Security and Medicare. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount. As youre running through the calculations above be sure to talk to a financial pro to help you weigh the.

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

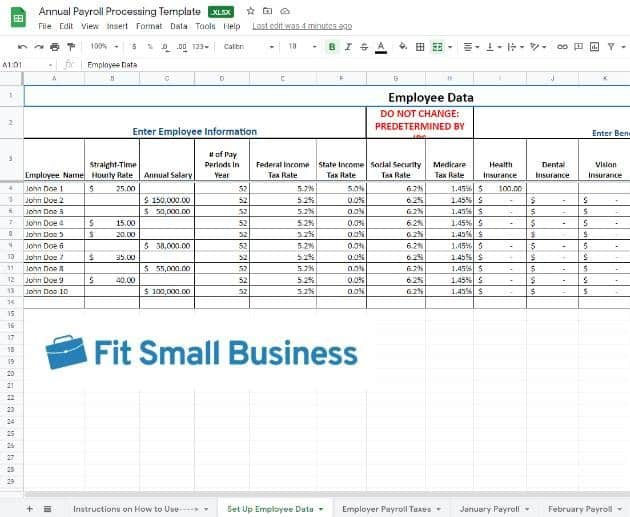

How To Do Payroll In Excel In 7 Steps Free Template

Get Our Sample Of Home Renovation Project Management Template For Free Marketing Plan Template Business Plan Template Business Continuity Planning

Explore Our Image Of Recording Album Budget Template Budget Template Budgeting Budget Spreadsheet

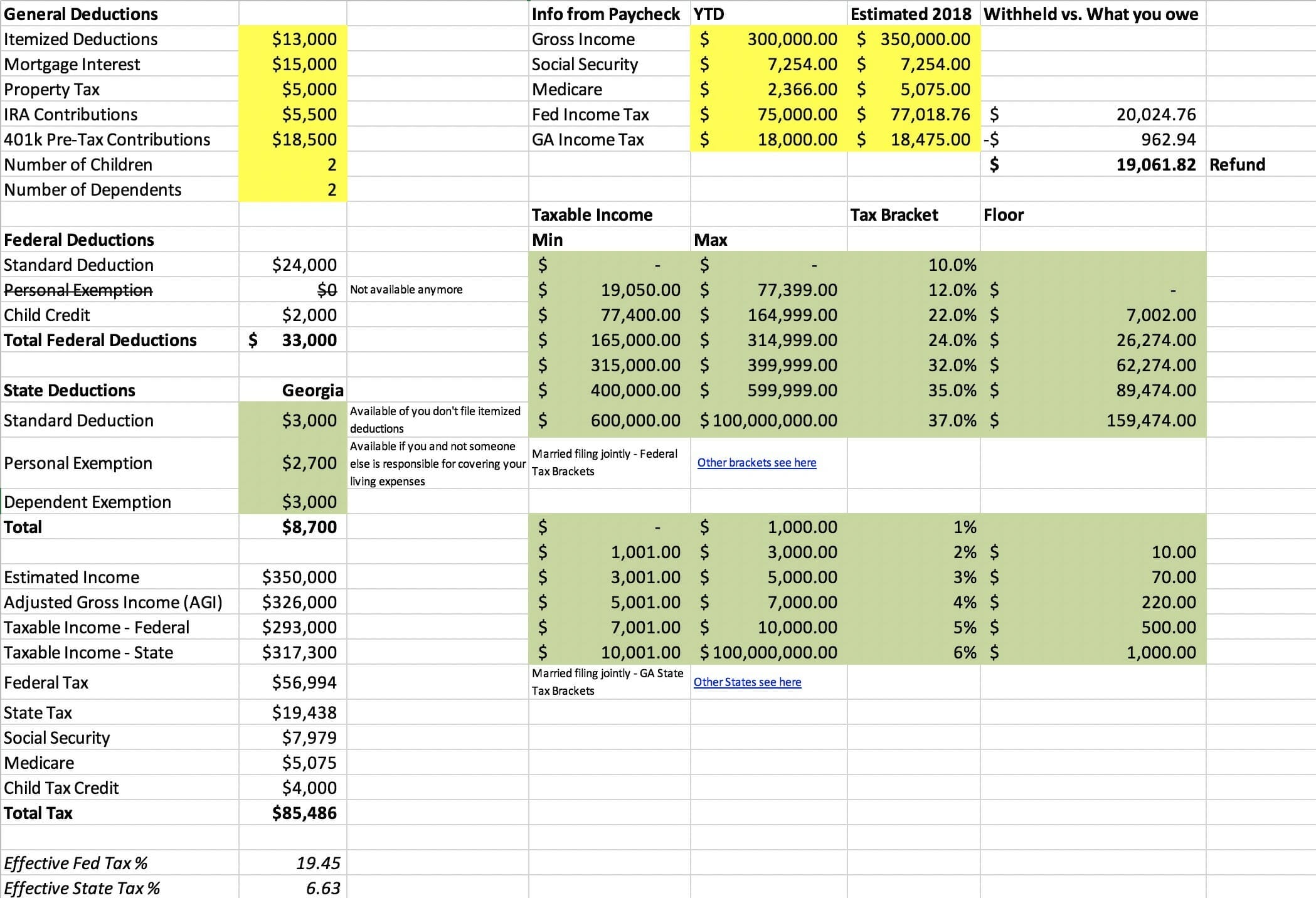

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

49 Make A Professional Report With These Free Download Income Statement Template Here Statement Template Income Statement Personal Financial Statement

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Applicant Tracking Spreadsheet Download Free And Free Lead Tracking Spreadsheet Template Excel Templates Business Spreadsheet Template Spreadsheet Design

Ar Aging Excel Template Tutorial Video And Download Accounts Receivable Youtube Report Template Excel Templates Computer Jobs

Trucking Spreadsheet Trucking Companies Spreadsheet Spreadsheet Template

What Business Expenses Can I Write Off For Taxes 20 Biggest Tax Deductions Small Biz Numbers Girl Business Tax Deductions Business Expense Big Business

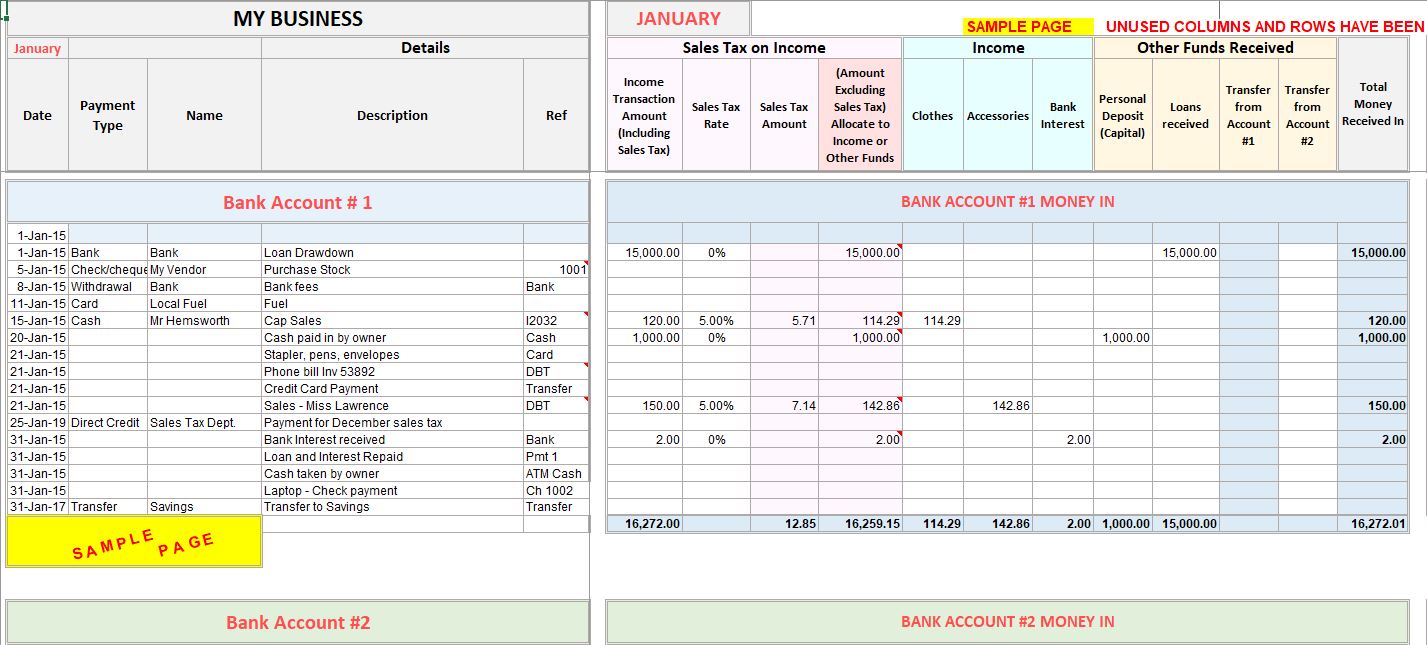

Accounting Excel Template Income Expense Tracker With Sales Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Opening Day Balance Sheet Template Balance Sheet Template Personal Financial Statement Balance Sheet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Do Payroll For Single Member S Corporation Amy Northard Cpa The Accountant For Creatives Payroll Small Business Tax Small Business Bookkeeping